Book Review: Money Wise by Deepak Shenoy

As soon as I read the book Money Wise by Deepak Shenoy, I was filled with regret. I wondered why this book was not there when I first started earning.

Many years back, I was given an investment tip by a friend who told me to buy a 100 shares of a firm. It was a lot of money and I wondered whether I should put all my eggs in one basket. After a lot of hesitation, I did buy 50 shares and sure enough every single day, the share price kept going up. I was rich (at least that day, I was). That evening, my friend came home and told me that I should immediately sell the shares. He left in a hurry. I tried locating the share certificates (this was pre-demat days), but could locate the share certificate. When I found them a month later, kept safely in my office (and I was looking for them at home), I discovered that the shares were worthless. The company had gone bankrupt.

Money Wise by Deepak Shenoy is a book written for someone

Who knows that it is important to save

But does not know where to start

Gets overwhelmed by the financial jargon that everyone else seems to know

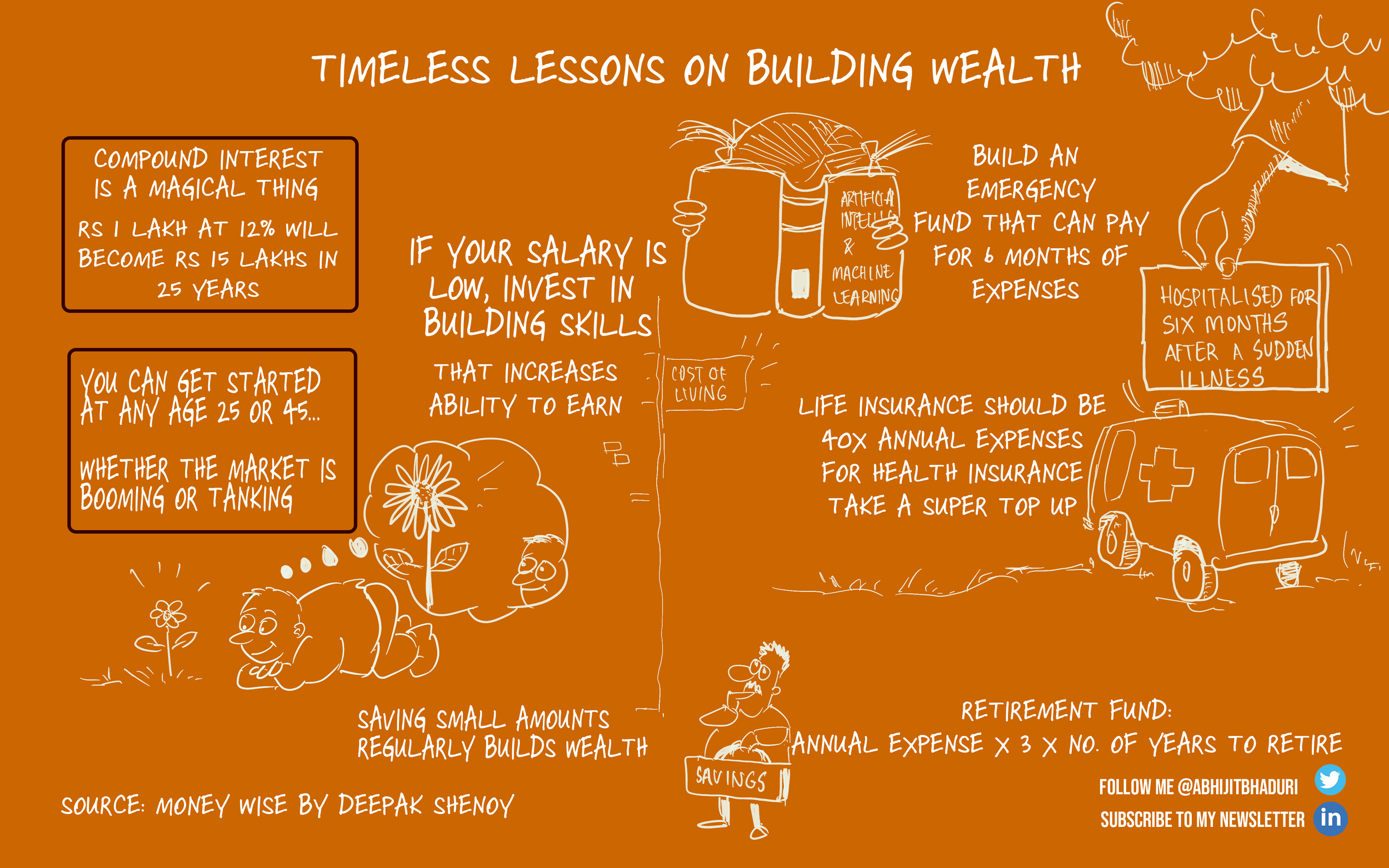

I made some notes that you may find useful.

If you are early in your career

Create an emergency fund that can fund 6 months of expenses. This is important in case your regular source of income stops (eg layoff, stuck in a bad marriage etc)

Life insurance is meant for your loved ones who depend on your income. Take an amount equal to 40 times your annual expenses + any loans that must be paid back

Health insurance should be something you must have even if your employer takes care of it. Buy a Super Top Up insurance plan (suggested Rs 80 lakhs coverage) where you pay say the first five lakhs of hospitalisation and then the insurance company takes care of the balance Rs 75 lakhs. This is priceless in case you are hospitalised for a long stretch

Pay off your credit card dues 100% every month.

If you are not earning enough to save, then you must invest money in upskilling yourself rather than trying to scrounge and save from an already meagre salary. That is a terrific piece of advice. Deepak mixes serious financial advice with humour. I have turned one of the anecdotes in to a cartoon

Deepak’s book is a courage builder. It tells you that no matter how old you are, you can get started with these simple tips.

You can check his website at Capital Mind to find out how much you need to save to build a Retirement Fund. For example if you spend Rs 1 lakh a month, multiply it by 3 and multiply it by years left to retire to get a rough estimate of what your retirement fund should be.

I absolutely recommend this book. It tells you that you don’t need a lot to get started. And don’t get so obsessed with saving for the future that you forget to live in the moment.

Subscribe to my newsletter on LinkedIn <click this>

Follow me on LinkedIn and Twitter @AbhijitBhaduri